The deadline for filing your tax returns and paying your bill is fast approaching. Hundreds of thousands of Irish people have their calculators at the ready as the clock ticks towards October 31, the cut-off date by which taxpayers must file their return for 2017. The self-assessment system of taxation applies not just to the self-employed but to anyone with income from sources that are not chargeable under pay as you earn (PAYE). Anyone with rental income, farming income, foreign incomes, to name but a few, must get their financial house in order in the coming weeks.

PAY AND FILE:

Under the ‘pay and file’ system, October 31 is the date by which you must pay:

1. Any balance of income tax owing for 2017.

2. Preliminary tax for the tax year 2018.

It is also the date by which you must file your tax return for 2017. If you are on the Revenue’s records as self-employed, you should receive a pay and file slip from the tax office to enable you to pay the tax by the due date. If you do not receive a slip, you should request one because under self-assessment the obligation is on you, not Revenue, to ensure your return is filed, and your tax is paid on time.

NOT JUST FOR THE SELF-EMPLOYED:

Traditionally, filing a tax return is seen as something that the self-employed do at this time of year. However, even if you are an employee, you could still need to file a return. Failing to do so could result in penalties, so make sure you find out in plenty of time if you have a requirement to make a return.

SURCHARGE FOR LATE RETURNS:

You must return the completed 2017 Tax Return on or before October 31 to avoid a surcharge. If your Return is late the surcharge, which is added on to your tax due, is: Five per-cent of the tax due where the Return is submitted after October 31 and on or before December 31. Ten per-cent of the tax due, where the Return is submitted after December 31

AUDIT/PENALTIES:

Self-Assessment Returns are subject to audit by Revenue, tax law provides that Revenue may make any inquiries or take such actions as are considered necessary to verify the accuracy of a Return.

HOW CAN WE HELP:

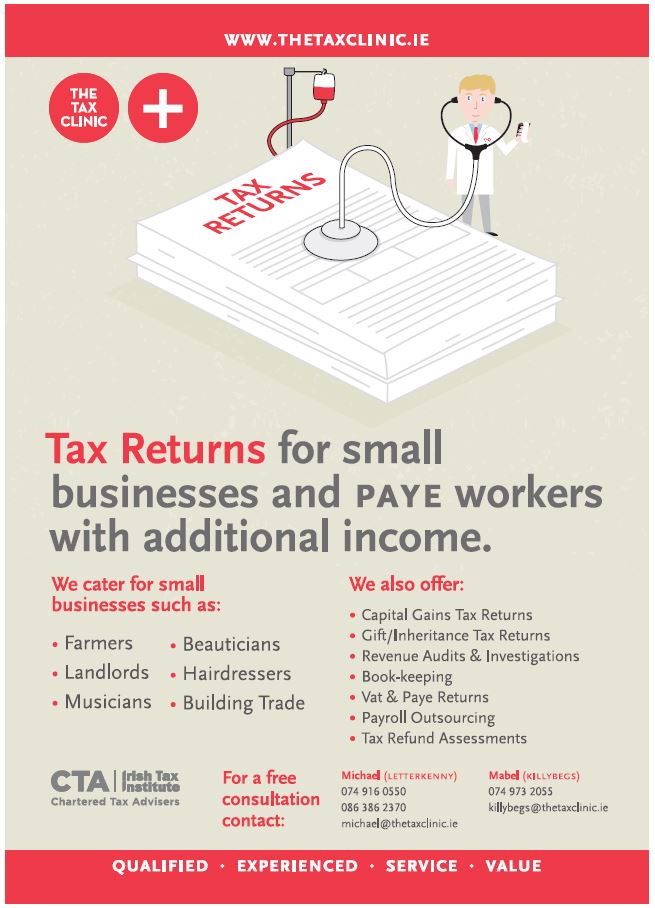

So does the idea of doing your taxes make your tummy rumble? Do you even know where to start? At The Tax Clinic we specialise in completing tax returns for small businesses and PAYE workers with additional income. As qualified accountants and chartered tax advisors we have the knowledge and experience to assist with all your tax and accounting needs. But what makes us really unique is our focus on providing fantastic customer service. We’re so professional and helpful you might actually enjoy getting your taxes sorted. To find out more log onto www.thetaxclinic.ie or call into our offices at either the High Road, Letterkenny, or Main Street, Killybegs.

SPONSORED CONTENT BY: THE TAX CLINIC