I WANT TO START UP AS A SOLE TRADER BUT DON’T KNOW WHERE TO START?

Firstly, let me congratulate you on taking the first steps to becoming self-employed. Working for yourself can have many advantages, but you also need to consider the long hours and irregular income you may have especially at the beginning. It is relatively simple to set up as a sole trader. As the name implies, it refers to one individual who owns and operates a business. A sole trader can have employees to assist with the running of the business, but it is the sole trader who owns the business, taking all the risks and rewards.

HOW DO I REGISTER FOR INCOME TAX WITH THE REVENUE?

You can register as a self-employed sole trader by either using Revenue’s online service (ROS) or by completing a paper form called a TR1. Registering online is the fastest and most efficient way of registering for Tax. You must provide basic information such as name, address, date of birth, PPS number and your marital status. Regarding the business you have to indicate what you intend doing e.g. plumber, mechanic, hairdresser etc, the date of commencement, expected turnover, business address and if you will be registering for Value Added Tax (VAT) or PAYE/PRSI if you intend hiring employees.

REGISTRATION OF BUSINESS NAME

If you wish to use a business name you must register the name with the Companies Registration Office (CRO). You can register the name by filling in a form called an RBN1. It costs €40 if completed in paper format or €20 if done online. The business registration certificate is needed for opening a bank account in the business name.

VAT

You will need to register for VAT if you have a vatable activity and if you are over the annual sales threshold – €37,500 (in the case of supply of services) and €75,000 (in the case of supply of goods). VAT is a very complicated tax and care should be taken in relation to preparing your VAT returns for submission to Revenue. I would advise getting professional help if you are in any doubt as to how to prepare these returns.

PAYE/PRSI

If you intend hiring employees to assist you in running your business you will have to operate a manual or computerised payroll system ensuring you deduct the appropriate amount of tax, USC and Prsi on all payments made to your employees. Normally the tax, USC and Prsi deducted is paid over on a monthly basis to the Revenue on a form called a P30. You will also have to provide payslips, holiday pay, bank holiday pay, maternity leave and any other leave governed by the employment law applicable to the industry you are in.

Again I would advise getting professional help if you are not comfortable calculating and preparing payslips and completing the monthly Revenue returns. Breaches in employment law cost businesses millions of euro every year so getting the right advice is of the utmost importance in this area.

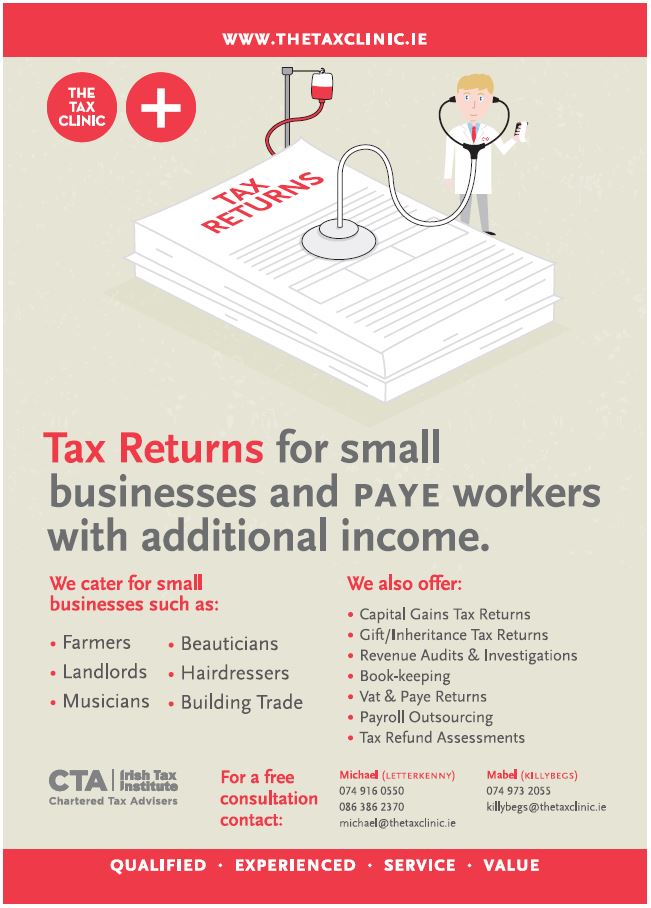

WWW.THETAXCLINIC.IE

The Tax Clinic is the only business in the Northwest that specialises in completing Tax Returns for small businesses and Paye workers with additional income. As Chartered Tax Advisers we have the knowledge and experience to assist you with all your taxation needs. Our offices are based at the High Road Letterkenny and Main Street Killybegs.

SPONSORED CONTENT BY: THE TAX CLINIC