The Tax Clinic at High Road, Letterkenny

The Tax Clinic at High Road, Letterkenny

HUNDREDS of thousands of Irish people have their calculators at the ready as the clocks tick on towards an important date.

The upcoming pay-and-file deadline marks the date by which taxpayers must file their return for 2016. The self-assessment system of taxation applies not just to the self–employed, but to anyone with income from sources that are not chargeable under pay as you earn (PAYE). So those with rental income, farming income, foreign incomes must also get their financial house in order in the coming weeks.

PAY AND FILE:

Under the ‘pay and file’ system, October 31st, 2017 is the date by which you must pay

1. Any balance of income tax owing for 2016

2. Preliminary tax for the tax year 2017

3. It is also the date by which you must file your tax return for 2016.

NOT JUST FOR THE SELF-EMPLOYED:

Traditionally, filing a tax return is seen as something that the self-employed do at this time of year. However, even if you are an employee, you could still need to file a return. Failing to do so could result in penalties, so make sure you find out in plenty of time if you have a requirement to make a return.

SURCHARGE FOR LATE RETURNS:

You must return the completed 2016 Tax Return on or before 31 October 2017 to avoid a surcharge. If your Return is late the surcharge, which is added on to your tax due, is:

• 5% of the tax due where the Return is submitted after 31 October 2017 and on or before 31 December 2017.

• 10% of the tax due, where the Return is submitted after 31 December 2017.

AUDIT/PENALTIES:

Self – Assessment Returns maybe subject to Audit by Revenue, Tax law provides that Revenue may make any inquiries or take such actions as are considered necessary to verify the ac- curacy of a Return.

TYPES OF REVENUE AUDIT: DESK AUDIT

The Inspector will request that certain books and records be left at the Tax Office for inspection.

VISIT TO BUSINESS

The Inspector will call to your place of business and after an initial interview will examine the books and records. This Audit may be confined to one Tax Head eg. Income Tax or may extend to cover all relevant taxes.

NOTIFICATION OF A REVENUE AUDIT:

21 Days Notice of a Revenue Audit is generally given to both the Taxpayer and his/her Agent. The scope of the audit will be set out.

TAXPAYER DISCLOSURE:

The Taxpayer can make a “Prompted Qualifying Disclosure” before the examination of the books and records begin. This disclosure must be made in writing and is accompanied by a Declaration that all matters contained in the disclosure are correct and complete. A payment of the tax due, together with interest on late payment of that tax, must also be included. The advantage of a Qualifying Disclosure is that the Taxpayer avoids Publication of the Tax Settlement and also the amount of penalties due will be reduced.

HOW IS THE CASE SELECTED:

There are several reasons why a Tax Return may be selected for a Revenue Audit.

• Informed selection from the risk profiling of cases using computer assisted profiling as well as local knowledge.

• Emphasis of a particular Sector or Scheme where the margins etc may not conform to Industry norms.

• Random Audit programme.

The deadline for filing your tax returns and paying your bill is fast approaching

The deadline for filing your tax returns and paying your bill is fast approaching

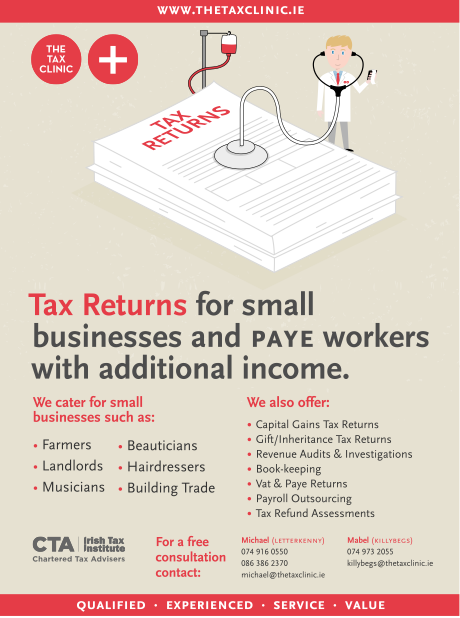

WWW.THETAXCLINIC.IE was founded in February 2010 by Michael Coll & Mabel McHugh. The Tax Clinic is the only business in the Northwest that specialises in completing Tax Returns for small businesses and Paye workers with additional income. As Chartered Tax Advisers we have the knowledge and experience to assist you with all your taxation needs. Our offices are based at the High Road Letterkenny and Main Street Killybegs.

SPONSORED CONTENT BY: THE TAX CLINIC