The trend for home improvements among Irish adults appears to be more popular than ever with a significant two thirds carrying out renovations or DIY in the past three years alone. The latest research by the Irish League of Credit Unions also found that one fifth are planning to extend their homes in 2017 by either paying for an attic or garage conversion, or building on an extension.

Funding home improvements and renovations can be a costly undertaking. A quarter of those polled said they spent between €1,000 and €3,000 on improvements, while four in ten said they spent up to €1,000. With bills like this, it’s understandably many will need a little help to fund their dream DIY projects. Perhaps not surprisingly, of those who said they would borrow to carry out their improvements, 60% said they would use their local credit union – and that’s in no small part because of the great value available.

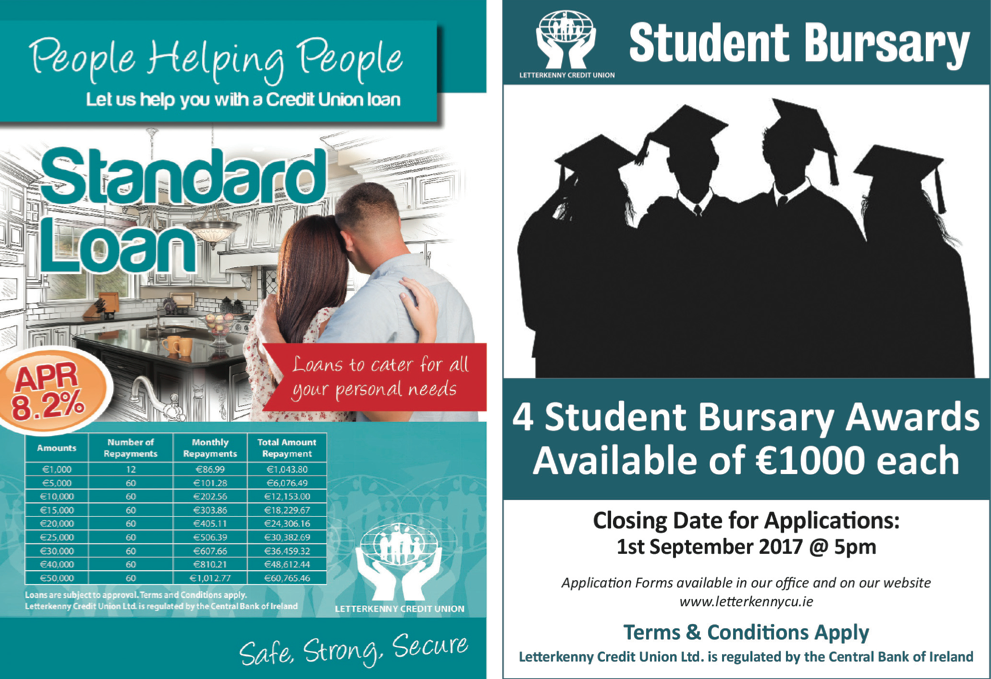

A home improvement loan from Letterkenny Credit Union has a very affordable APR rate of 8.2%*. Not only that, but there are no administration fees or hidden chargers and repayments can be structured in a way that suits everyone’s individual circumstances.

Commenting on the loan, Letterkenny Credit Union said “With home improvements so popular in the Letterkenny area, we’ve been receiving an increasing numbers of enquiries about how our credit union can help. We’ve been telling people that our Home Improvement Loan is offered with realistic terms and repayments can be made in a way that works best for each individual. There are no penalties for paying a loan back early, and should you need to restructure payments, you are always welcome to talk to us about this. So you can sit back and enjoy your dream home without worrying about the costs.”

The national survey also found that laying down new carpets and flooring is the most popular home improvement with 42% reporting they were upgrading their homes in this way. Installing new heating or insulation systems followed closely behind at 38%. Fitting new windows or doors was the third most popular home upgrade at 23%.

Letterkenny Credit Union continued “Whatever dream renovations people have planned for their homes in 2017, and no matter how big or small the project might be, we would encourage them to contact us here at Letterkenny Credit Union and find out how we can assist.”

** For a €20,000, 5 year variable interest rate loan with 60 monthly repayments of €405.06, an interest Rate of 7.95%, a representative APR of 8.2%, the total amount payable by the member is €24,302.76. Information correct as at 24th August 2017.

For further information please contact: Letterkenny Credit Union on 074 91 24166 or email info@letterkennycu.ie

SPONSORED CONTENT BY: LETTERKENNY CREDIT UNION